We Help Your Clients Afford Your Higher-Value Services By Helping Them Secure Affordable Funding

So You Can Remove The Money Objection & Impact More Lives!

Outsource Your Payment Plans:

Remove Your Risk & Get Paid In Full, Up Front

5-Minute Explainer:

^ Click to Expand

When your USA-based customer applies for funding using our platform, they receive an assortment of options so that they can choose what is most compatible for them.

Seamlessly provide your customers with a multitude of options at your live events, virtual events, on your website, during webinars (live or recorded), email marketing, SMS text, social media posts and comments, DMs, or during sales calls.

Enroll more clients into your higher-value, done-for-you services so you create more impressive success stories, which in turn attracts even more committed clients.

Get more for your advertising spend by accommodating all profiles, including those with less-than-perfect situations, lowering your overall cost to acquire a customer.

Enjoy a real-time dashboard that displays approvals and loan amounts 24/7.

^ Click to Expand

Consultants, Speakers, Trainers, Coaches, Course Creators

Doctors, Dentists, Cosmetic Surgeons, & Healthcare Practitioners

Contractors, Construction, HVAC, Solar, & Landscaping

Attorneys & Law Firms

Financial, Estate, & Tax Advisors

Education, Training, & Certification Programs

Architects & Interior Designers

High-End Artists & Designers

Retreats, Experiences, & Luxury Travel

Weddings & Event Planning

Software, Blockchain, & Tech Development

Advertising and Marketing Agencies... And more!

^ Click to Expand

Instant approvals on their screen, and your clients can receive their funds within 2-3 days.

Revenue Boost: Businesses usually see an instant 15% to 40% income increase. (Your sales reps can therefore earn more, too!)

Currently 79% of applications are approved.

Enroll more high-value services and done-for-you packages.

Offer funding on your website, via direct messages, email, SMS, webinars, social media, checkout pages, and live events.

We even can accommodate clients with less-than-perfect credit.

No more allowing payment plans: Reduce collection/cashflow issues.

Your team can check all application statuses in our portal 24/7.

Spend more time serving and scaling, not chasing payments.

For established businesses, funds can go directly to your business.

Feel good helping your clients qualify for the industry's lowest rates:

Don't let financial barriers stand in the way of your client's success.

Enroll More Clients Into Your Premium Services:

Make your services more affordable by offering financing to your clients with payments over 12-60 months with zero prepayment penalties. Reach a wider audience and enroll clients into your higher ticket programs to better serve them.

Your clients enjoy the benefits of your coaching program with affordable monthly payments and you get paid upfront and in full.

Make A Bigger Impact & Expand Your Mission's Reach

ApproveMyFunding helps you live your mission and make a larger impact by providing your clients with a new way to invest in your services.

Reach new audiences and transform more lives with your message by making your materials more affordable to more people through financing.

No More Chasing Payments

ApproveMyFunding helps you live your mission and make a larger impact by providing your clients with a new way to invest in your services.

Reach new audiences and transform more lives with your message by making your materials more affordable to more people through financing.

Funds Received Within 2-3 Days

We understand that generating new revenue is critical to growing your business. Self-financing makes it harder to predict your cashflow when there are unforeseen payment plan issues, payment card expiration dates, or defaults.

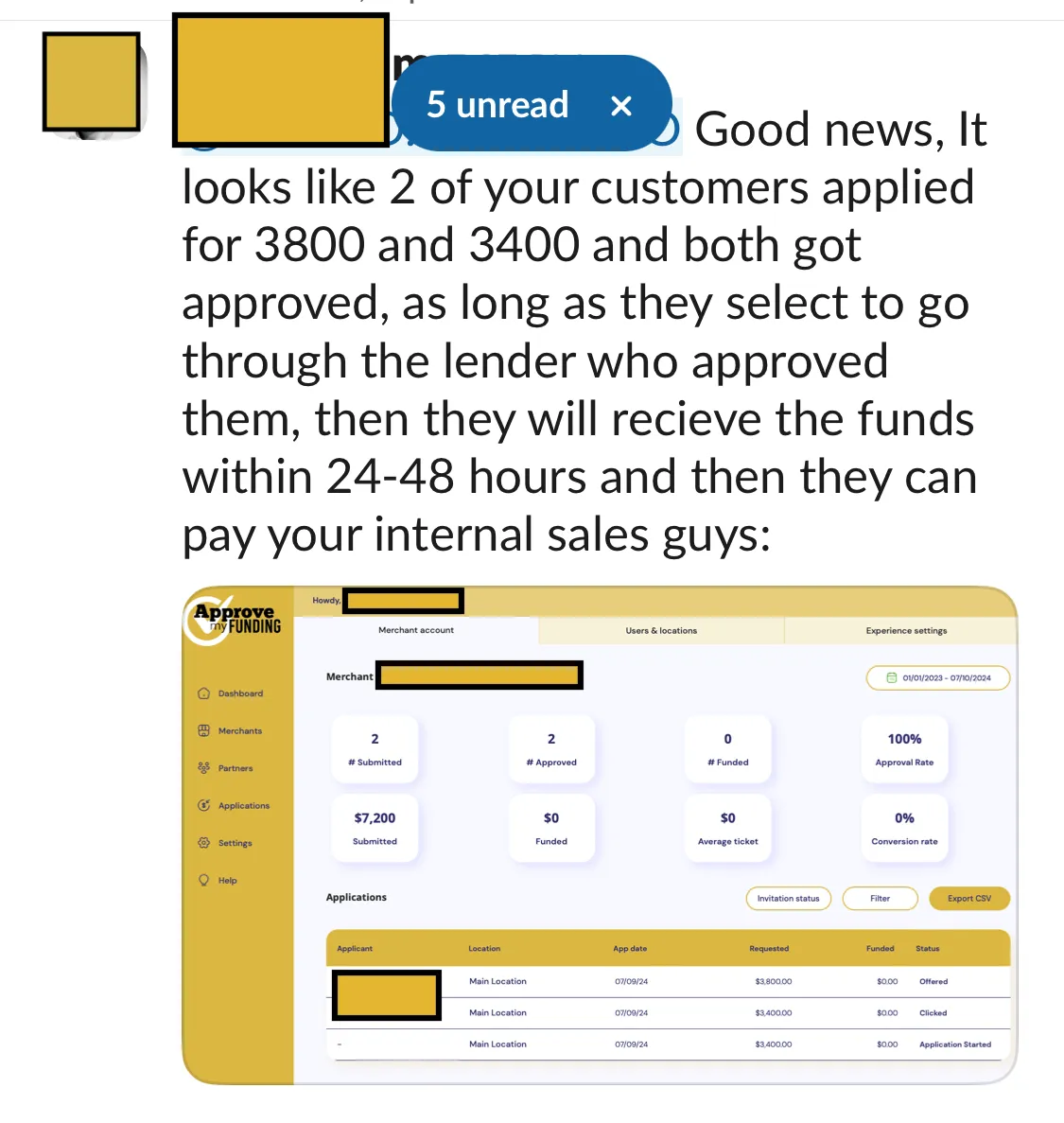

When your clients use the ApproveMyFunding platform to secure funding to pay for your consulting services, they receive their funds within 48-72 hours via direct deposit. This way they can pay you in full, plus its faster, easier, and gives them the ability to choose their favorite approval terms.

Help Your Clients Avoid "Credit Card Stacking"

"Credit card stacking" or "loan stacking" is when your customer applies for multiple new credit cards or uses multiple existing cards to purchase. This can actually harm their credit score and/or lead to higher-interest financing, which might put them in a more difficult financial situation. We offer straightforward funding solutions, with affordable payments, fair rates, all over a fixed term. No surprises and no pre-payment penalties.

Schedule Your Demo Now:

What Business Owners Say:

"I was like, even if this only helps me enroll just one more $5,000 client a year, it's still worth it, complete no brainer."

"It's SO easy!"

"65% approval rate so far! $31,000 worth and it's only my first week."

"The first customer I connected to ApproveMyFunding received a $15,000 approval."

His first day using ApproveMyFunding:

Case Study:

A Real Estate Investment Coach tried 3 other finance platforms, but wasn’t happy with their approval rate, funding rate, or the ease of checking application statuses. He switched to using ApproveMyFunding.

In the last 30 days: 60% of applications were approved.

Of 12 approvals, 3 funded.

So instead of doing $66,000 in cash collected this month, another $44,000 was funded through ApproveMyFunding, helping him reach $110,000 in cash revenue for the month.

40% of cash revenue came from our funding platform!

He’s happy he switched: Now he has money to scale his advertising this month and add another sales rep.

What You Get With ApproveMyFunding

Full access to all of the lenders on our platform who understand the value of what you do and who want to lend to your type of customers.

Beautiful back-end dashboard for you and your sales reps to check the funding status of all applications 24/7.

A team member will show you how to use everything quickly.

We build you a custom-branded webpage for your business where your customers can apply for funding right away.

Example Websites We Make For Your Customers To Visit:

Our founders have worked with, spoken at, or been featured on over 200 media appearances, features, brands, and stages, including:

^ Click to Expand

How to navigate your portal,

What your prospects will see when they apply,

A visual tour of the application process,

An example of what your company-branded site will look like,

The opportunity to ask us your questions, and

How to get started on the platform to start submitting applications right away.

"What kind of businesses are most compatible with the platform?"

All businesses with higher-priced services and products:

☑️ Consultants, Speakers, Trainers, Coaches, Course Creators

☑️ Doctors, Dentists, Therapists, & Healthcare Practitioners

☑️ Contractors, Construction, HVAC, Landscaping, etc.

☑️ Attorneys & Law Firms

☑️ Financial, Estate, & Tax Advisors

☑️ Education, Training, & Certification Programs

☑️ Architects & Interior Designers

☑️ High-End Artists & Designers

☑️ Experiences & Luxury Travel

☑️ Weddings & Event Planning

☑️ Website, Software, Blockchain, & Tech Developers

☑️ Advertising and Marketing Agencies

... And more!

"Are secured loans offered too, in addition to unsecured financing options?"

- Yes.

"What auto disqualifies someone?"

- There’s about 25 lenders who each have different criteria, so whichever lender is open to approving them, will.

"How low of a credit score will be approved?"

- Personally, we’ve seen around 570 approved. It's a soft pull to apply (and its free to apply) so the borrower might as well.

"What’s the highest interest rate?"

- We have a few very high risk lenders that sometimes approve just about everyone, but the rates are higher than credit cards. So if it makes sense for the customer, they can move forward.

"Can these loans be for B2B?"

- The owner of a business can personally apply for a loan and use the funds for the business, but they use their social security number to apply. They won’t see “SBA Loan” approvals through our platform for example.

The platform was specifically designed for B2C, however many of the customers that find loans through our platform are business owners who used the funds to grow their business (for working capital, advertising, etc).

"The funds go from the lender to the customer, and then the customer pays the merchant?"

- Correct. However: businesses that have been in business for at least 1 year and can show at least $1MM in revenue for the last 12 months can apply for our “Direct to Merchant” solution where the customer’s loan agreement allows the lender to send the funds directly to the merchant. The service fees that the merchant pays ApproveMyFunding are usually higher for this additional service feature, but many merchants still prefer that option.

"Minimum loan size?"

- $1,000 is the minimum amount a lender will do.

"What about Spanish speakers?"

- The lending application process is in English, and so are the loan documents.

"What's the onboarding process for a business look like?"

After getting started on our platform, the business owner will receive a TXT message and an email from us asking them to sign our very simple service agreement.

They receive a link to see our short videos that explain how to use the portal, how/when to present the funding platform during their sales calls, and also a short walkthrough of what the application process for their customer looks like.

And the business owner will also receive an email to help them create their login credentials to their dashboard.

"Will the lenders want to know anything about my business for each customer loan?"

No, as of today we have never heard of a merchant using our platform being contacted by the lender for any reason. Its between the lender and your prospective client/customer. When your customer uses our platform through the website page that we make for you, the lender then knows that your business is registered with us.

"Should I link my company website to the funding website you make for me?"

This is more of a sales strategy question:

Some merchants have a link on their website that says like "Funding" or "Get financing" to make it easier to find during the sales environment. So the rep might say "Visit our website, scroll down to the footer, see it says Financing? Click there. Okay this is our application, lets see what payment plans you qualify for."

Some businesses have a sentence on their website like "we offer financing" but it isn't a clickable link. The sales team only gives it to people inside of the sales cycle.

Some businesses don't mention it on their website at all, and it's just a tool they use in the sales environment.

Examples: A furniture store's website might say "We offer financing" because consumers know how much furniture is and wouldn't be deterred away from seeing that on the website. A B2B consultant might not share "We offer financing" on their website because the prospective client might be concerned how much their consulting is: In this case, it may be best to wait until they enter the sales environment to share the financing options.

"Does the merchant need to have a USA-based business entity?"

- Yes. As long as an international business has a USA-based entity, they can be on the platform. But the borrower (customer) will need a Social Security Number.

"What if the customer/borrower is not a US Citizen?"

- The portal asks for SSN, so if they don’t have a SSN, they won’t be able to click “submit” on the loan application.

"Is there a paper application to sign up with? For the merchant or the customer?"

- There are no paper applications: it’s a technology platform so all lenders are integrated into our technology platform (for speed).

Zero Risk Guarantee:

Use with Confidence.

ApproveMyFunding

Copyright © 2024 Iconic Solutions AI, LLC

All Rights Reserved.

Brought to you by www.IconicSolutions.ai