Enroll Now:

Get Access To Our Entire Funding Platform:

Access all lenders who specifically lend money for customers who are seeking higher-priced services.

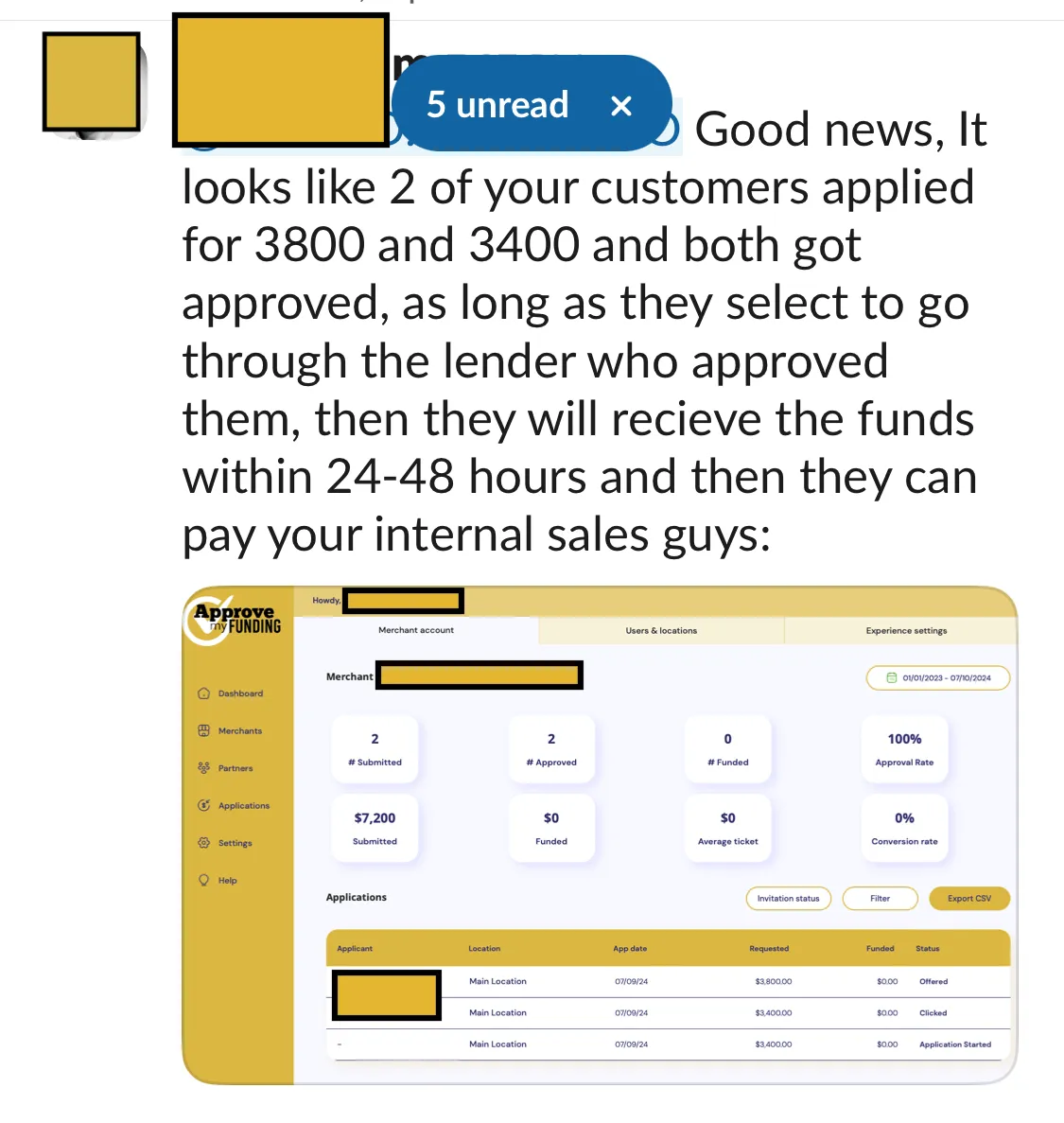

Pre-approvals come to your customer immediately upon them applying for funding.

Most programs fund within 48 hours of the customer requesting the funds to be sent.

We work with all credit profiles, including those with challenged credit, so you can help more people.

Access to our robust platform: You can check the status of your applications without waiting for a human.

Pricing:

We priced ourselves similar to just running a credit card transaction.

Enrollment & Setup:

One-time setup fee of $495 to setup the platform, create your custom-branded landing page to send to prospects, and offer live-data reporting in your portal for all application statuses.

Monthly Platform Service:

$49.95/month. (First month is included)

Service Fee:

5% of the amount that the customer pays you is our service fee on each loan.

Example: If your customer is approved for $15,000 but only takes $10,000, though you only receive $8,000 from the customer, you are only billed 5% on the $8,000.

Onboarding Time:

When you enroll, today we can have you entirely up and running within approximately 1 business day! Immediately after you enroll, you will be invited to create your portal real quick. (Your branded portal is where your customers will go to apply for funding.)

Next Steps:

Enroll above now so the very next time a prospect says "I can't afford it" you can immediately take them through the ApproveMyFunding application while "live" on the call, this way they can already start seeing approvals on their screen as soon as they click Submit!

We have found that businesses that get their portal setup -before- the next time a client says they can't afford it enroll more clients because its important to enroll someone when they are ready and "live" on the call with you. Get set up now!

FAQ:

"What is the Money Back Guarantee?"

Upon approval, if within 30 days:

~ The merchant does not feel ApproveMyFunding’s platform is helping enroll more clients or it won’t be able to increase their revenue by at least what they paid, and

~ They have submitted at least 10 applications to give it a test run, and

~ We’ve had the opportunity to consult them on those applications:

…. They can let us know and we can provide them with an immediate refund of their Setup Fee.

"The funds go from the lender to the customer, and then the customer pays the merchant?"

- Correct. However: businesses that have been in business for at least 1 year and can show at least $1MM in revenue for the last 12 months can apply for our “Direct to Merchant” solution where the customer’s loan agreement allows the lender to send the funds directly to the merchant. The service fee that the merchant pays ApproveMyFunding are sometimes higher, but many merchants are highly interested in that option.

"Does the business need to have a USA-based business entity?"

- Yes. As long as an international business has a USA-based entity, they can be on the platform. But the borrower (customer) will need a Social Security Number.

"What if the borrower is not a US Citizen?"

- The borrower will be asked for a SSN, so if they don’t have a SSN, they won’t be able to click “submit” on the loan application.

"Does each location pay a setup fee/monthly subscription? Any enterprise discounts?"

- Each location pays the fee, and each location gets their own portal, and the owner can access each portal separately.

- For businesses with over 20 locations, the fee for each location's setup is $395.

- For businesses with over 100 locations, the fee for each location's setup is $295.

- Each location pays the $49.95 fee for their platform.

Next steps: A merchant enrolls for $495, and then they can let us know during onboarding how many locations they have, and we will invoice them for the remaining locations.

What Business Owners Say:

"I was like, even if this only helps me enroll just one more $5,000 client a year, it's still worth it, complete no brainer."

"It's SO easy!"

"65% approval rate so far! $31,000 worth and it's only my first week."

"The first customer I connected to ApproveMyFunding received a $15,000 approval."

His first day using ApproveMyFunding:

Case Study:

A Real Estate Investment Coach tried 3 other finance platforms, but wasn’t happy with their approval rate, funding rate, or the ease of checking application statuses. He switched to using ApproveMyFunding.

In the last 30 days: 60% of applications were approved.

Of 12 approvals, 3 funded.

So instead of doing $66,000 in cash collected this month, another $44,000 was funded through ApproveMyFunding, helping him reach $110,000 in cash revenue for the month.

40% of cash revenue came from our funding platform!

He’s happy he switched: Now he has money to scale his advertising this month and add another sales rep.

Our founders have worked with, spoken at, or been featured on over 200 media appearances, features, brands, and stages, including:

Zero Risk Guarantee:

Use with Confidence.

ApproveMyFunding

Copyright © 2024 Iconic Solutions AI, LLC

All Rights Reserved.

Brought to you by www.IconicSolutions.ai